I understand these changes involve a lot of acronyms and might seem complicated. While I can’t simplify the legislation itself, I’ll break down these complex regulations into more straightforward terms, starting with explaining who is a Designated Beneficiary (DB) and how they are impacted by the final RMD

regulations.

A DB Explained

A DB is any of the following:

- A non-spouse individual who is not chronically ill or disabled

- A child of the IRA owner who has exceeded age 21 and is not chronically ill or disabled

- A non-spouse individual who is more than 10 years younger than the deceased IRA owner

10-Year Test

Before we go further, let’s review the third bullet regarding “more than 10 years younger” rule. It sounds straightforward because the IRS has traditionally used attained age to determine if the IRA owner’s spouse is more than 10 years younger. Attained age is based on the entire year. For example, the IRA owner was born in 1945 and the spouse in 1955 they are not more than 10 years. Therefore, more than 10 is 11 years or more.

This 10-year test doesn’t work the same way. The IRS decided to make it exactly 10 years based on the deceased owner’s and beneficiary’s date of birth. Here’s an example to try to explain this convoluted rule. If the IRA owner’s DOB is October 1, 1953, and the beneficiary’s DOB is on or before October 1, 1963, the beneficiary is not more than 10 years younger. Had the beneficiary been born on October 2, 1963, the beneficiary would be more than 10 years younger.

Inherited IRA Impact

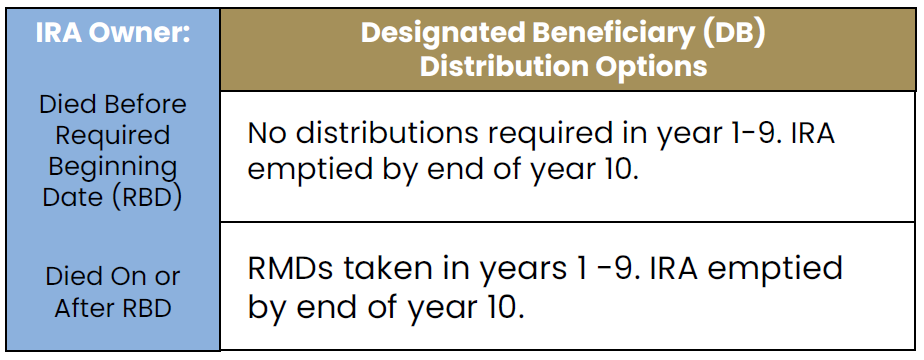

Clients who are DBs need to understand how the final regulations impact their Inherited IRA. First, verify whether the IRA owner died before or on/after their Required Beginning Date (RBD). This controls whether the DB needs to take RMDs during the 10-Year term. Then you will need to be familiar with the 10-Year Rule.

RBD and RMD Explained

The RBD is April 1 following the year the IRA owner reached their RMD age. The term “RMD age” has been a moving target over the past few years. RMD Age is:

- Age 75 (if born in 1960 or later) [still proposed]

- Age 73 (if born after 1950)

- Age 72 (if born after June 30, 1949)

- Age 70 ½ (if born before July 1, 1949)

RMD Age for Those Born in 1959

One caveat to the above is regarding the RMD age for anyone born in 1959. SECURE Act 2.0 states, “In the case of an individual who attains age 72 after December 31, 2022, and age 73 before January 1, 2033, the applicable age is 73. In the case of an individual who attains age 74 after December 31, 2032, the applicable age is 75.”

Let’s do the math for “attain age 73 before 2033 or 74 after 2032”: 2032 – 73 = 1959; 2033 – 74 = 1959. Either way, the year is 1959. So, which RMD age applies, 73 or 75? This is where the proposed final regulations come to the rescue. According to these proposed regulations, for anyone born in 1959, their RMD age is 73.

10-Year Rule

You’ve determined if the owner died before on or after RBD. Next, you need to know the 10-Year Rule for a DB’s Inherited IRA. This rule requires the Inherited IRA be fully distributed by the end of the 10th year following the year of the original IRA owner’s death.

During this 10-year term, if the original owner died on or after their RBD, DBs must take RMDs annually. These RMDs are calculated using the DB’s single-life expectancy divisor and the prior year-end IRA value, following a term-certain calculation method. This method involves subtracting one from the original divisor in each successive year.

However, if the owner died before their RBD, or a Roth IRA was inherited, there are no distributions required before year 10. The Internal Revenue Code (IRC) mandates the Inherited IRA must be

completely emptied by the end of the 10th year, regardless of whether the total distributions exceed the RMD. You can think of the amount left in the account in the 10th year as the RMD. If RMDs aren’t taken, an excise tax of 25% of the amount not taken is imposed. This 25% tax can be reduced to 10% if the missed amount is taken within the correction window.

RMDs Are Really Not the Issue

I’ve discussed the rules and explained RMDs, but it’s important not to get too focused on them. Why? Regardless of whether RMDs are necessary, the real issue is taxes.

Before the SECURE Act, a beneficiary could stretch an Inherited IRA by taking RMDs over their single-life expectancy using the term certain method. This typically allowed the account to remain open until age 85, at which point it would be fully depleted.

Now, under the SECURE Act, some DBs must use the calculation method but no longer have the luxury of stretching distributions over an extended term. Instead, they are required to distribute the entire account in 10 years. This change in the rules makes tax management a crucial aspect of handling your client’s

distributions, unless they inherit a Roth IRA.

This is where your focus should be. Whether or not you provide tax advice, it’s essential to educate your clients on this matter. Fin CW, LLC offers software which simplifies this process for financial professionals, making it easier to effectively manage distributions.

Proposed Final Regulations – Spouse Edition

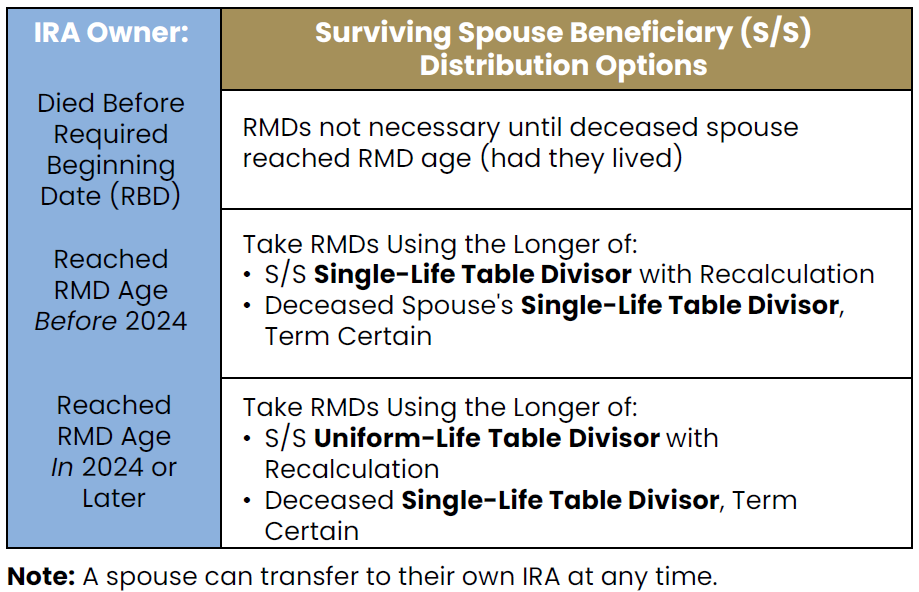

Turning our attention to the other proposed final regulations, we see a new twist for spouse beneficiaries. When a surviving spouse (S/S) establishes an Inherited IRA, RMDs are necessary:

- If the deceased spouse died on or after their Required Beginning Date (RBD).

- The year the deceased would have turned RMD age, had they lived.

Generally, the S/S establishes the Inherited IRA when they are under age 59 ½. Why? If the S/S transfers the assets into an IRA in their name and takes a distribution before age 59 ½, they could owe the 10% additional tax for early distributions. An exception to this tax is for death, as Inherited IRA distributions use the death code on IRS Form 1099-R.

Spouse Can Use the Uniform Table – What???

When RMDs are necessary, the S/S uses the Single Life Expectancy Table, like a non-spouse beneficiary. No other table has been allowed for Inherited IRA RMD calculations until now. The proposed regulations for Section 327 state the S/S can use the Uniform Life Expectancy Table, but their deceased spouse has to reach RMD age in 2024 or later.

Spousal Election Under Section 327

So far so good, right? But wait, there’s more. Spousal Election Under Section 327 of the SECURE 2.0 Act says a S/S can take RMDs or follow the 10-year rule if the deceased died before RBD.

Additionally, it allows a S/S to:

- Be treated as the employee (IRA owner) if the deceased spouse died before their RBD.

- Delay RMDs until the deceased spouse would have reached RMD age, had they lived.

- Be treated as the employee (IRA owner) if the S/S dies before RMDs would have begun in the Inherited IRA.

Truthfully, these rules are more clarifications. The SECURE Act initially required the S/S to elect the above provisions. The proposed regulations clarify this election is automatic if the deceased spouse dies before their Required Beginning Date (RBD).

Deceased Spouses Dies on/after RBD

What happens if the deceased spouse dies on or after their RBD? The plan or IRA custodial agreement must be amended to make the election the default provision.

To put it another way, a S/S can be treated as the IRA owner while assets are in an Inherited IRA. This means they can use the Uniform Life Table, avoid the 10% additional tax if they take a distribution, and delay RMDs until the deceased spouse would have reached RMD age. Remember, a S/S can always transfer the assets to an IRA in their name and have no RMDs until they reach RMD age.

One Final Twist

When you think you have a handle on all the IRS changes, invariably there’s one more to add to the complexity. When the S/S is older than the deceased spouse who died on or after their RBD, the S/S can open an Inherited IRA and take RMDs based on the longer life expectancy.

The S/S has two options:

- Use the Uniform Life Table divisor (if RMD age is reached in 2024 or later) or the Single-Life Table divisor (if the deceased spouse reached RMD age before 2024). This method allows for recalculating each year, meaning the S/S obtains a new divisor annually.

- Use the younger deceased spouse’s Single-Life Table divisor from the year of death on a term-certain basis.

This doesn’t sound too complex, does it? Even so, because the S/S recalculates, meaning they obtain a new divisor each year, it is important to review the longer life expectancy to determine if or when a crossover of the lives occurs. What does this mean? Even if the deceased spouse’s life expectancy starts out longer, the S/S’s life expectancy will eventually become longer. This is especially true if the S/S can use the Uniform Life Table divisor with recalculation.

While this is more of a fringe scenario, you should be aware of this rule. This is because, usually, the S/S will transfer the inherited assets to their own IRA if they are over 59½, or once their deceased spouse would have reached RMD age, had they lived.

Break Analytics Can Help

I hope this information has been helpful. I understand it can be overwhelming, like drinking from a firehose. The great news is clients and financial professionals don’t have to remember all these rules thanks to Fin CW’s solution, Break Analytics. The modules in Break Analytics incorporate these and other regulations with illustrations tailored to a specific beneficiary and their rules. Financial professionals who want to learn more can request a demonstration of the software by visiting www.fincw.com.